Affiliates that promote credit card products and services compete for over a billion dollars worth of business in this particular market sector. If you don’t mind a little healthy rivalry and you’re always looking for ways to boost the speed and quality of your returns, this particular market segment can be the perfect fit for you.

Affiliate programs for credit card companies are often ranked among the most lucrative in the industry. There are prosperous credit card affiliates working inside the community of The Affiliate Lab who are able to receive high five-figure monthly commissions with ease. The process of getting accepted is difficult, but there is a strategy that should be followed.

Throughout the course of this article, we will discuss the top affiliate programs for credit cards and take you step by step through our research into the characteristics of all of them. Remember that we didn’t just pick affiliate programs at random, we put some thought and years of affiliate experience into it and we investigated the products that are being promoted by other affiliate websites in this niche.

In this article, we take a look at 12 of the most successful affiliate programs that are associated with credit card companies. You will gain an understanding of what differentiates each option from the others, how they can assist you, as well as a summary of the programs and policies they offer.

Table of Contents

Amerixan express affiliate program

American Express has a long and illustrious history, and it is often regarded as one of the world’s top providers of financial services.

Since its inception, American Express has maintained a stellar reputation for providing outstanding service, as well as a very reliable reputation, around the clock and worldwide. American Express is extremely proud of its reputation and strives to earn and maintain its customers’ trust by performing to the highest possible standards.

Basic terms and conditions American Express affiliate program:

- 30 days cookie time

- Always recent banner material available

- Regular actions that are suitable to promote through the affiliate channel.

- Rejection takes place if the order is not within the conditions and guidelines of the affiliate program or if there is no actual order

- Inspections take place on a monthly basis; given that new clients have to go through an application procedure, it may take up to several months before the commission is finally awarded.

Program name: Amerixan Express affiliate program

Commission: From €2.50 up to €110.00 per product CPS

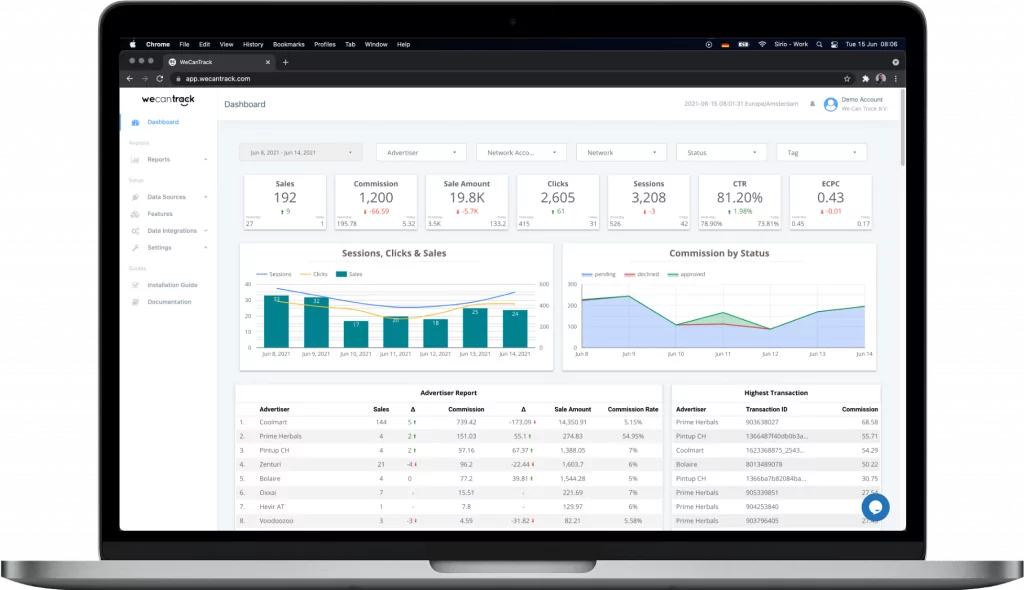

Network / Software: Daisycon (integration available with wecantrack)

Cookie duration: 30 days

Find more information about the American Express affiliate program here.

Square affiliate program

Square helps millions of sellers run their business. Join the affiliate program to today and get paid for referring new customers. Commissionable services in the program including Payments, Point-of-Sale, Invoices, Appointments & Payroll.

The Squareup Affiliate Program operates on a Cost Per Sale (CPS) model with single-tier commissions and a fixed commission structure. Affiliates earn commissions based on their sales, with a minimum payout threshold of $100. The program welcomes traffic from around the globe and provides a range of promotional materials.

Program name: Square affiliate program

Commission: $5.00 per sign up and up to $233.00 depending on the product used

Network / Software: Impact (integration available with wecantrack)

Cookie duration: 45 days

Find more information about the Square affiliate program here.

Chime affiliate program

Because so many banks and other financial institutions provide customers with a complete menu of account choices that come with various extra features and benefits, it can be challenging to identify the one that is the most suitable for their requirements. Instead of providing you with many options, Chime keeps things straightforward by offering a single checking account, savings account, and secured credit card, all of which are integrated into a slick mobile app.

Chime affiliate program is very attractive since it offers good support, recurring revenues and a great market niche to operate in.

When you refer someone and they purchase Chime, you receive 10% of the Monthly Recurring Revenue (MRR) from that sale for 18 months. When your referral refers someone who purchases Chime, both you and your referral receive 10% of that new MRR for 18 months.

Program name: Chime affiliate program

Commission: 10% of the MRR for 18 months.

Network / Software: Tapfiliate (integration available with wecantrack)

Cookie duration: 30 days

Find more information about the Chime affiliate program here.

CreditCards.com affiliate program

CreditCards.com serves as a comprehensive online resource dedicated to all aspects of credit cards. Established by Bankrate, a company with a rich history in financial services dating back to 1976, CreditCards.com benefits from 17 years of specialized experience in the credit card sector.

For affiliate marketers, CreditCards.com offers a versatile platform that isn’t tied to a single company or credit card. By directing your audience to CreditCards.com, you provide them with a broader selection, increasing the likelihood they will find a credit card that suits their needs. The website’s Card Match tool further assists customers in identifying their ideal credit card.

Their program is available on the Bankrate Credit Cards affiliate network where you can find their program and many other for relevant credit card providers.

Bankrate’s affiliate program includes several key benefits:

- Access to offers from major card issuers

- Competitive monthly payouts (specific commissions and cookie durations are not detailed on their landing page)

- User-friendly tracking and reporting tools

- Availability of creative and marketing materials online

- Excellent affiliate support services

Program name: Bank Rate Credit Cards Network

Commission: Varies depending on bank partner

Network / Software: Custom

Cookie duration: 45 days

Find more information about the Barclays affiliate program here.

Upgrade affiliate program

People with poor credit ratings or anyone who wants to finance a significant purchase can benefit from the unique offering that is the Upgrade Cash Rewards Visa, which does not charge an annual fee. It promotes itself as having “the flexibility of a credit card with the low cost and dependability of a personal loan,” and in reality, it may be utilized in both of these contexts:

Make purchases with it as you would with a credit card, and the money you spend will be turned into installment loans at a predetermined interest rate. If you continue to carry a balance after the due date, you will have the option to refund the balance in equal monthly payments over a certain time period. Sutton Bank is the company that actually issues the card.

To get a personal loan, you can use some of the available credit you have and then ask for the money to be deposited into your bank account. You have the option of repaying the loan in equal monthly payments over the course of a predetermined time period and at a predetermined interest rate. (However, the card cannot be used to withdraw cash from an automated teller machine.) The lending partners of Upgrade are the ones who provide individual loans.

This is a significant departure from the operation of the vast majority of credit cards, but it has the potential to make monthly budgeting much less difficult. Additionally, you will receive a healthy 1.5% cash back on all purchases made with the Upgrade Cash Rewards Visa. In spite of this, if you have good to excellent credit, you may have a variety of options available to you with an introductory APR of 0% to select from if you need to carry a load on your credit card.

Program name: Upgrade affiliate program

Commission: 2% Personal Loan Issued, $75.00-$200.00 Card Issued

Network / Software: Impact (integration available at wecantrack)

Cookie duration: 30 days

Find more information about the Upgrade affiliate program here.

USAA affiliate program

Through the USAA affiliate program, your audience members who are part of the military community (together with their families) will have access to USAA.com’s extensive selection of extremely competitive financial goods and services. One of the few companies in the United States that offers a comprehensive range of financial services, this company offers a variety of goods, including checking and savings accounts, credit cards, investments, financial planning, life insurance, and more.

This affiliate program should ideally be marketed to active duty service personnel, veterans, and their loved ones who are looking for a reliable source of financial solutions to satisfy their requirements.

Program name: USAA affiliate program

Commission: $25 Per Lead

Network / Software: FlexOffers (integration available with wecantrack)

Cookie duration: 30 days

Find more information about the USAA affiliate program here.

Capital One affiliate program

Capital One is an example of a corporation that does not wish to be classified solely as providing financial services. A brief scan of their website reveals that they provide a variety of additional services, any one of which can serve as an additional incentive for your audience to make a purchase.

Keep in mind that in order to benefit from Capital One’s programs, you are need to already be a cardholder of their credit cards who is in good standing. To participate in the program, you must also own one of the following credit cards: Quicksilver, QuicksilverOne, Savor, SavorOne, Venture, VentureOne, Platinum, or Secured Mastercard.

To get started, there is an initial step of signing up, registering, and signing up for an account. After you have been reviewed and accepted, you will be given a unique referral link that you can utilize for affiliate marketing purposes.

Program name: Capital One affiliate program

Commission: $100 cashback

Network / Software: PerformCB (integration available at wecantrack)

Cookie duration: 30 days

Find more information about the Capital One affiliate program here.

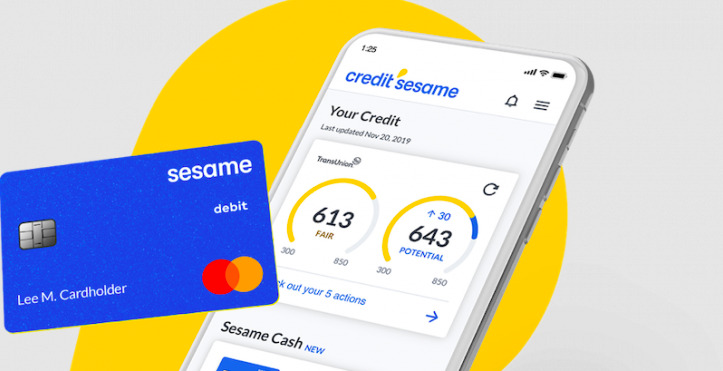

Credit Sesame affiliate program

Your website’s visitors will have access to CreditSesame.com, a free platform for credit and debt management, if you participate in the affiliate program offered by Credit Sesame, which offers a free credit score and free credit monitoring. Credit Sesame provides your site visitors with the resources they need to better manage their finances, including their loans, credit card payments, and mortgages.

Joining Credit Sesame does not require a credit card or a trial period, and all of the services that are made accessible to members are free of charge. These services are geared for home owners as well as renters. The eye-catching creative and extended cookie referral time offered by the Credit Sesame affiliate program are both designed to increase the number of customers who make a purchase.

Program name: Credit Sesame affiliate program

Commission: $3.00-$6.00 per signup

Network / Software: FlexOffers (integration available at wecantrack)

Cookie duration: 30 days

Find more information about the Credit Sesame affiliate program here.

Final Remarks

You must have observed, throughout our presentation of credit card affiliate programs, that there is no such thing as the “ideal” credit card to advertise. For example, reward cards will appeal to one audience, while travel cards would appeal to another audience.

To market a credit card, you don’t even need to be a successful affiliate marketer in the financial industry. It is necessary that you have some basic understanding as well as the willingness to market the card.

Therefore, keeping the aforementioned information in mind, you should do your research, join any affiliate program for a credit card that is the most suitable for you, add value to your audience, and begin generating money online.