Affiliate networks play an important role in connecting advertisers and publishers. These networks serve as a powerful bridge, enabling businesses to leverage the influence and reach of affiliates to drive sales and brand awareness.

A recent statistic proves that over 80% of brands use affiliate marketing to generate leads and sales.

Therefore, we’ve researched the following statistics and added expert quotes to help you with everything from tracking mobile traffic growth to analyzing conversion rates across different niches.

Table of Contents

Key Affiliate Network Statistics

Affiliate networks have become a cornerstone of digital marketing, offering businesses a powerful way to connect with a global audience through partnerships with affiliates.

- 60% of total affiliate marketing revenue is generated by the top five affiliate networks. 5

- $8.2 billion is the expected revenue from affiliate marketing in the US by 2025. 5

- Over $1.2 billion is paid out annually by leading affiliate networks. 7

- $0.45 is the average Earnings Per Click (EPC) across major affiliate networks. 4

- 2.5% is the average conversion rate across all affiliate networks, with top networks reaching 5%. 8

- 70% of affiliate networks operate on a Cost Per Sale (CPS) model. 5

- 55% of traffic in affiliate networks comes from mobile devices. 5

- 45% of global affiliate traffic comes from North America. 2

- 68% is the year-over-year retention rate for affiliates within networks. 4

- 70% of affiliate network revenues come from ecommerce, fashion, and health & wellness niches. 2

- 85% of US publishers use affiliate networks for monetization. 2

- 30 days is the typical payout frequency for most affiliate networks. 1

- 190 countries are served by the top affiliate networks. 5

- 60% of affiliate links are generated through networks. 5

- 30% increase in earnings during peak seasons like Black Friday and Cyber Monday. 6

- 15-20% of digital marketing budgets are allocated to affiliate marketing through networks. 7

Takeaways From These Statistics

There is a high market concentration, and the five largest affiliate marketing networks account for 60% of the total sales. This means that the high-performing networks have the necessary tools, partnering affiliations, and network capability to obtain the majority of affiliate-related revenues. The overall earnings were $4,030 with an average Earning Per Click (EPC) of $ 0. 45 and conversion rates 2. Up to 5%—the best networks show 5%—strategies outlined show how affiliates can climb the ladder step by step. To a large extent, affiliate marketing success is defined by the networks’ choice and the rates and conversions that come with it.

Mobile has become more dominant in affiliate networks and currently contributes to 55% of all traffic. It also shows that all the affiliates require mobile optimization of their content to gain a lot of clicks and consequent conversions. This proves that some niches are more profitable, as 70% of affiliate revenues are generated from the ecommerce, fashion, and health & wellness sectors. It can, therefore, be said that affiliates that are active in these areas, specifically those dealing with U. S. publishers where a shocking 85% of all publishers use affiliate networks, will stand to gain big.

The global presence was one of the main advantages of the select affiliate networks that work in 190 countries and are responsible for 60% of affiliate links. Partnerships with the networks benefit affiliates as they provide the opportunity to have a global reach, and sales can increase up to 30% during Black Friday.

It is common for networks to have a payout cycle of 30 days, which is favorable for an affiliate’s cash flow. With online media expenditure dedicating 15-20% to affiliate marketing, the latter can benefit from increasing investment in the given field.

Key Affiliate Network Statistics

| Year | Active Networks | Global Spend (USD Billion) | Average Commission Rate (%) | Percentage of Advertisers (%) | Mobile Traffic Share (%) |

|---|---|---|---|---|---|

| 2020 | 180 | 10.5 | 25 | 78 | 50 |

| 2021 | 190 | 11.7 | 26 | 80 | 52 |

| 2022 | 200 | 12.8 | 27 | 81 | 55 |

| 2023 | 210 | 13.0 | 28 | 82 | 55.5 |

- $150,000 is the potential annual earning for top affiliates in major networks. 7

- $100 is the average cost to acquire a new affiliate through a network. 6

- 40% of affiliate networks offer scalable solutions for small and medium-sized businesses. 7

- 65% of affiliate networks provide cross-channel tracking capabilities. 1

Top Performing Affiliate Networks By Revenue

Understanding the revenue dynamics of leading networks can offer valuable insights for both marketers and affiliates looking to align with the most successful platforms.

- $6.4 billion in revenue was generated by the top-performing affiliate network in 2023. 1

- 3 of the top 10 affiliate networks control over 50% of the market share by revenue. 1

- 15% annual growth is seen in revenue for the leading affiliate network over the past five years. 2

- $200 million is the average monthly payout by the highest-grossing affiliate network. 1

- 5 of the top 10 networks have an average commission rate of 10-15%. 5

- $1.5 billion was paid out to affiliates by the second-largest affiliate network in 2023. 4

- 70% of the revenue from top affiliate networks comes from ecommerce and retail sectors. 4

- 25% year-over-year increase in revenue was reported by one of the top 5 affiliate networks. 7

- 60% of top affiliate network revenue is generated from mobile traffic. 2

- $3.2 billion was the combined revenue of the top 3 affiliate networks in the last quarter of 2023. 7

- 85% of affiliates on the top networks earn their highest income from a single network. 2

- $100 million in monthly revenue is generated by affiliates specializing in financial products on leading networks. 1

- 40% of total revenue in top networks is driven by recurring commissions from subscription services. 3

- 10 million clicks per day are generated on average by the top-performing affiliate network. 4

- 30% of the top network’s revenue is attributed to affiliates in the technology niche. 3

- $500,000 is the highest monthly earnings reported by an individual affiliate in a leading network. 5

- 20% of the top network’s revenue comes from affiliates in the health and wellness industry. 4

- 80% of affiliates in the top networks generate revenue from more than one region. 4

- $120 million in annual revenue is generated from influencer marketing on the top affiliate networks. 6

- 50% of the top affiliate networks’ revenue comes from partnerships with over 1,000 premium advertisers. 7

Key Industry Drivers In Affiliate Networks

The highest-earning affiliate networks earned $6. This proves that the industry is relatively large in revenues, generating $4 billion in revenue. The top three have managed to capture more than 50% of the market share, showing that it is a duopolistic market. Other more recognized networks also reported a 15% annual revenue increase in the past five years as a sign of the network’s growth and effectiveness.

Higher revenue: the monthly revenue from the top-grossing network is $200m and $1. 2012 and from the second largest to the third largest affiliate marketing company by grossing $5 billion in 2023, The figures show how remunerative affiliate marketing is especially for high-performing affiliates.

The majority of the revenues—70%—from the top affiliate networks originate from the e-commerce and retail industries, thus showing where most affiliate opportunities exist. Mobile traffic contributes 60% of revenue since consumers tend to shop on mobile devices.

Another type of revenue relates to subscription services, for which revenue was 40% of total income. The regularity of commissions received helps. Some make huge sales; one affiliate said their monthly sales reached $500,000. This alert proves that affiliates can be very profitable when they join an affiliate program.

Affiliate networks are also increasing in many sectors of the economy and across numerous world geographic areas. The technology niche drives 30% of the networks’ top revenue, with health and wellness affiliates accounting for 20%. These networks are also international, 80% of which receive revenues from more than one geographic area. The author has shown that influencer marketing has become an effective promotional tool, earning $120 million annually. Further, the strategic partnerships with more than 1000 top-notch advertisers contribute to 50% of the top five global networks’ revenues to support the fact that collaborations are crucial for future sustainable growth.

Global Reach Of Affiliate Networks

As companies increasingly seek to tap into international audiences, affiliate networks have become indispensable in learning between regions, languages, and cultures.

- 90% of affiliate networks operate in multiple countries, covering all major global markets. 4

- 45% of global affiliate traffic originates from North America, followed by 30% from Europe. 4

- 20% of affiliate network revenue comes from Asia-Pacific, showing significant growth potential in this region. 9

- 85% of global brands use affiliate networks to expand their reach into international markets. 9

- 70% of top affiliate networks have partnerships with publishers in over 100 countries. 9

- 25% of total affiliate sales are made outside of the affiliates’ home countries. 2

- 65% of global affiliate transactions are conducted in local currencies, supporting international diversity. 3

- 15 languages are supported on average by leading affiliate networks, ensuring broad accessibility. 3

- 30% of global affiliate revenue is generated from cross-border ecommerce. 5

- 50% of affiliates in Europe are connected to networks based in the United States. 5

- 40% of affiliate networks report that Latin America is their fastest-growing region. 4

- $2.3 billion in global sales was generated by the top international affiliate network in 2023. 4

- 35% of global affiliate traffic is directed toward mobile devices, with the highest growth in Africa and Southeast Asia. 6

- 75% of affiliate networks offer localized marketing materials to support affiliates in different regions. 6

Global Reach Takeaways

Affiliate marketing networks are geographically diverse, with 90% of the companies claiming a presence in other countries and all the big markets. The affiliate traffic in North America has been the highest globally, accounting for 45%, while that in European countries is 30%. In comparison, Asia-Pacific countries represent a growth potential of 20% of the total revenue generated. Currently, most global brands use affiliate networks (85%) to enter foreign markets, and 70% of the leading networks work with publishers in more than 100 countries. E-commerce-related affiliates are especially significant, taking 30% of the total affiliate income; this will further prove the globalization of this sector.

To reach a wide range of audiences, 65% of all affiliate transactions are executed in local currency, and major networks offer an average of 15 languages. Furthermore, 75% of affiliate networks offer localized marketing material useful to affiliates in diverse locations. It demonstrates that most of the affiliates’ sales are gained internationally, where 25% of the total sales are generated from countries different from the affiliates’ countries. Mobile traffic is quickly increasing primarily through the affiliate links, with Africa and South East Asia leading with 35% of global traffic.

Based on the types of networks and companies’ specializations, it is clear that affiliate networks are also going international, as is apparent from their revenues and partners. In 2023, according to data obtained, the largest global affiliate network produced $2. Organic food makeup was estimated to have 3 billion dollars in global sales. European affiliates obtain networks, with 50% of the connections referring to the United States of America networks, which shows that the industry is international.

Latin America is one of the most active regions, where 40% of affiliate networks claim a high growth rate. These trends indicate that affiliate marketing is now prevalent worldwide and opens great opportunities for expansion in emerging markets.

- 40% of global affiliates specialize in niche markets specific to their region, such as fashion in Europe or technology in Asia. 7

- 50% of global affiliate networks have offices or representatives in more than five countries. 7

- 60% of global affiliate networks use geo-targeting to optimize performance across different regions. 8

- $1 billion in annual revenue is generated by affiliates in emerging markets, including India and Brazil. 5

- 80% of global affiliate networks have affiliates in at least three continents. 5

- 35% of global affiliate networks are expanding into new regions, with Africa and the Middle East as key targets for growth. 5

Conversion Rates Across Leading Affiliate Networks

For both marketers and affiliates, understanding the conversion rates across top networks is key to optimizing campaigns and improving overall performance.

- 5% is the average conversion rate across the top-performing affiliate networks. 9

- 10% is the highest conversion rate reported by a leading affiliate network in the health and wellness niche. 9

- 3.5% is the average conversion rate for ecommerce affiliates in the top 10 networks. 9

- 2% is the average conversion rate for affiliates promoting digital products on major networks. 9

- 7% conversion rate is achieved by affiliates specializing in subscription-based services. 8

- 1.8% is the average conversion rate for financial product affiliates across leading networks. 8

- 6% conversion rate is common in the fashion and apparel sector within top networks. 9

- 4% is the average conversion rate for affiliates in the technology niche. 9

- 8% is the peak conversion rate for affiliates during Black Friday and Cyber Monday on leading networks. 11

A 4% conversion rate is average in the technology niche, meaning 4 out of 100 customers who click an affiliate link for tech products will buy something. Even though this might sound insignificant, it is in fact a strong number for affiliate marketing, especially in highly competitive fields like technology.

The conversion rate narrates the potency of an affiliate’s content in encouraging site visitors and spurring them to take action, such as acquiring tech-related products and services. Affiliates in the tech space can improve their conversion rate through optimized content, focusing on the correct audience, and selecting products that have robust market appeal.

- 3% is the typical conversion rate for travel affiliates in the top networks. 7

- 12% is the highest conversion rate reported by affiliates in the education and online course sector. 7

- 4.5% is the average conversion rate for affiliates promoting consumer electronics. 5

- 2.5% is the average conversion rate for affiliates in the beauty and cosmetics industry. 6

- 1.5% is the average conversion rate for affiliates promoting B2B services on top networks. 5

- 9% is the highest conversion rate in the fitness and wellness niche within leading networks. 5

- 4% is the typical conversion rate for affiliates in the home and garden sector. 9

- 6.5% conversion rate is achieved by affiliates in the parenting and baby products niche. 9

- 2% is the average conversion rate for software affiliates on major networks. 2

- 5% is the average conversion rate for affiliates in the outdoor and sports gear sector. 2

- 3% is the average conversion rate for affiliates in the entertainment and media niche across leading networks. 1

Geographical Distribution Of Affiliate Network Traffic

As affiliate networks continue to expand globally, analyzing traffic patterns from different regions becomes increasingly important for maximizing reach and effectiveness.

- 45% of global affiliate network traffic originates from North America. 11

- 30% of affiliate traffic comes from Europe, making it the second-largest region. 11

- 15% of affiliate traffic is generated from the Asia-Pacific region. 3

- 5% of global affiliate traffic comes from Latin America. 10

- 3% of affiliate network traffic is driven by users in Africa. 6

- 2% of global affiliate traffic originates from the Middle East. 11

- 60% of North American affiliate traffic is mobile-based. 7

- 70% of European affiliate traffic comes from desktop users. 4

- 40% of Asia-Pacific affiliate traffic is driven by social media channels. 3

- 50% of Latin American affiliate traffic comes from search engines. 7

- 25% of North American affiliate traffic is directed towards ecommerce platforms. 7

- 35% of European affiliate traffic is focused on travel and hospitality. 7

- 20% of Asia-Pacific affiliate traffic is related to technology and gadgets. 9

- 15% of global affiliate traffic to fashion retailers originates from Europe. 9

Geographical Takeaways

The dominance of the North American region is visible with approximately 45 percent of affiliate traffic, followed by Europe with 30 percent and Asia-Pacific with 15 percent only. Latin America and Africa have smaller percentages, contributing 5% and 3% respectively, while the Middle East contributes only 2%.

For instance, about 60% of North American affiliate traffic originates from mobile devices, while only 30% of Europe’s affiliate traffic is generated from mobile users. While social media architectures are dominant in the Asia-Pacific region, with a contribution of 40%, in Latin America, net architectures by search engines are dominant, with a contribution of 50%.

For instance, north American ecommerce affiliated traffic is drawn by 25% of the ecommerce platforms, the kind of consumer society that is encouraged. In Europe, 35% of traffic is focused on the travel and hotel sector; this demonstrates how much Europe depends on tourism. For instance, the Asia-Pacific region has a traffic distribution of 20% in technology and gadgets due to its increasing digital economy. Europe also ranks high in fashion retail traffic. It ranks second only to Asia as a source of 15% of global affiliate traffic in this sector, reflecting the well-developed region’s fashion industry.

These trends demonstrate that affiliate traffic has different tendencies depending on the region. North America has more traffic generated through mobile, which shows that its consumers are inclined towards using technology. In contrast, Europe has more traffic originating from desktops, which shows that their browsing habits differ.

The lack of social media in the Asia-Pacific region and the preference for search engines over social media in Latin America proves that local factors determine the characteristics of affiliate marketing worldwide. This dynamic should be considered by affiliates that target specific areas to improve their coverage and interactions.

- 10% of total affiliate network traffic is from emerging markets like India and Brazil. 11

- 55% of affiliate traffic in North America comes from users aged 25-44. 11

- 65% of European affiliate traffic is generated during peak shopping seasons. 11

- 30% of Asia-Pacific traffic is generated through affiliate marketing in the gaming industry. 3

- 20% of affiliate traffic in Latin America is related to health and wellness products. 3

- 40% of global affiliate network traffic growth is driven by expansion in Africa and Southeast Asia. 10

- 80% of new marketers start with affiliate networks as their primary monetization method. 12

- 70% of new affiliates earn their first commission within the first three months. 12

- $100 is the average monthly earning for new marketers in their first year. 12

- 60% of new affiliates focus on promoting digital products. 10

- 50% of new marketers choose Cost Per Sale (CPS) models for their first campaigns. 10

There is more participation from developing networks, as India and Brazil currently contribute 10 percent of the total affiliate traffic. Affiliate traffic studies in North America reveal that 55% of customers are between the ages of 25 and 44, suggesting that it is a good market for marketers. The above distribution of customers and traffic was observed to be synchronized with the peak shopping seasons, which take 65% of the total traffic in Europe.

Gaming accounts for 30% of Asia-Pacific traffic through affiliate marketing, while 20% of Latin America’s affiliated traffic is based on Health & Wellness products. In Africa and SE Asia, 40% of the network contributes to the growth of affiliate traffic globally.

For new marketers, affiliate networks represent the first step; 80% use them for monetization purposes; the first commission is earned within the first three months, 70%. New marketers make an average of $100 monthly in the first year of marketing, and 60% promote digital products. The CPS model is used most often by 50 percent of new affiliates because this model guarantees the payment of commissions every time goods are sold, which corresponds to the performance marketing business models.

These statistics show that affiliate marketing as a business model is global, versatile, and growing. It follows that the regions of operation are setting the tone on affiliation, not only for emerging markets, key age demographics, and industry specializations such as gaming in Asia-Pacific and health in Latin America. Also, the open entry for new affiliates and the relatively short time marketers can take to start making their commissions make affiliate marketing an attractive field to marketers, especially those entering the digital marketing arena.

- 40% of new affiliates find success using social media as their primary traffic source. 11

- 30% of new marketers see their highest conversions from email marketing campaigns. 9

- 90% of new affiliates prefer joining established networks for better support and resources. 9

- 20% of new marketers achieve a conversion rate higher than 3% in their first six months. 7

- $50 is the average cost to acquire the first sale for new affiliates. 7

- 15% of new marketers choose to promote niche products to stand out in the market. 7

- 25% of new affiliates use paid advertising to drive traffic to their offers. 12

- 35% of new marketers earn their first commission from promoting ecommerce products. 11

- 85% of new affiliates prefer networks that offer extensive educational resources. 9

- 5% of new marketers make over $1,000 in their first year. 8

- 75% of new affiliates stick to one or two networks to focus on specific niches. 8

- 95% of new marketers join affiliate networks with no upfront costs. 8

- 10% of new affiliates reach the top 10% of earners within their first year. 8

- 55% of new marketers rely on blog content to promote affiliate products. 6

- 45% of new affiliates experience higher engagement rates from mobile traffic. 5

Affiliate Network Growth Trends

Trends reflect shifts in consumer behavior and technological advancements and highlight the strategies driving success across the industry.

- 10% annual growth in the global affiliate marketing industry is driven by increased network activity. 1

- $12 billion is the projected value of the affiliate marketing industry by 2025, with networks playing a key role. 1

- 30% increase in the number of affiliate marketers joining networks over the past three years. 2

- 25% of networks report double-digit growth in affiliate sign-ups year-over-year. 11

- 15% increase in mobile traffic across affiliate networks since 2022. 2

- 40% of networks have expanded their geographic reach to emerging markets in the last five years. 8

- 60% of new affiliates prefer joining networks that offer AI-driven analytics and tools. 8

- 35% growth in the ecommerce sector within affiliate networks since 2020. 8

- 20% of networks have added influencer marketing to their offerings, boosting growth. 12

- 50% of networks report that social media is their fastest-growing traffic source. 10

- 70% of networks have seen an increase in partnerships with small and medium-sized businesses. 10

- 80% of networks offer training programs, contributing to a 25% increase in affiliate retention rates. 3

- 5% annual growth in conversion rates across leading networks. 4

- 25% increase in cross-channel marketing initiatives among top affiliate networks. 4

- 90% of networks now support multiple languages, reflecting global growth trends. 7

- 45% of networks have implemented subscription-based models, driving steady revenue growth. 5

- $1.5 billion increase in payouts by affiliate networks from 2021 to 2023. 5

- 55% of networks are integrating AI and machine learning to optimize performance. 8

- 20% year-over-year growth in the number of affiliates focusing on content-driven marketing. 11

- 65% of networks have enhanced their tracking capabilities, leading to more accurate performance measurement and growth. 9

Actionable Tips For Affiliates

The following three tips should be the key takeaways you should take from this article:

Use AI-driven tools: 60 percent of new affiliates chose networks that provide them with artificial intelligence solutions for analytical and performance improvements.

Expand into emerging markets: Since 40 percent of networks expand their sphere, the affiliates can focus on areas with low competition.

Focus on content-driven marketing: This approach has escalated by 20% year over year. Content operations like blogging and campaigns with influencers can enhance interaction and sales.

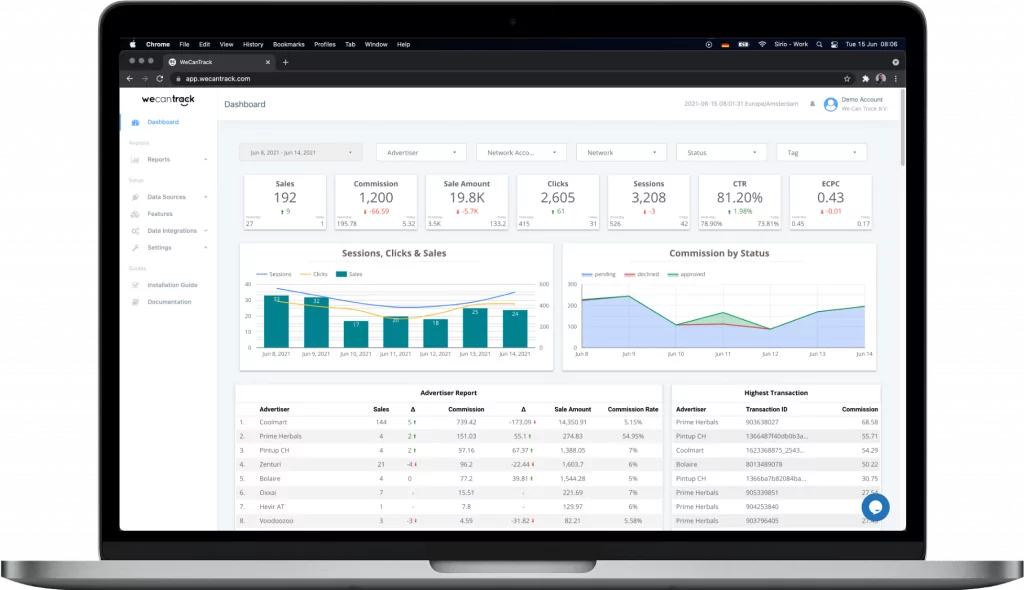

Use tools like wecantrack: wecantrack is a great affiliate tracking tool with over 350+ networks to help you connect and track your affiliate marketing campaigns.

Final Word

Affiliate marketing has grown to be a critically helpful tool for any organization that wants to perform various activities and engage in partnerships to generate increased revenues. These platforms are global, allow for detailed tracking, and provide a means for affiliates and merchants to operate, making great revenues across industries.

With the increasing mobile traffic and the emergence of narrow-focus markets, affiliates also have diverse opportunities to maximize their strategies based on the knowledge they have obtained and enter new markets. Such trends as AI inclusion and content-based advertising extend the prospects of affiliate networks as the drivers of the changing digital marketing environment.

There is an opportunity to achieve new heights of effectiveness for affiliates and businesses by selecting the correct network, targeting the right niches for optimization, and implementing novel tools.

Frequently Asked Questions

What is an affiliate network?

An affiliate network is a platform that connects affiliates (marketers) with merchants who want to promote their products or services. The network provides tracking, reporting, and payment solutions to facilitate these partnerships.

How do affiliate networks track conversions?

Affiliate networks use tracking links or cookies to monitor user actions such as clicks, leads, or sales. When a user completes a desired action (e.g., making a purchase), the network attributes the conversion to the appropriate affiliate.

What is the average conversion rate in affiliate networks?

The average conversion rate across leading affiliate networks is typically around 2-5%, depending on the niche, product type, and traffic source.

How much can I earn through an affiliate network?

Earnings vary widely based on factors such as the affiliate’s niche, traffic volume, and the network’s commission structure. On average, new affiliates might earn $100-$500 per month, while top affiliates can earn thousands of dollars.

Which regions generate the most affiliate network traffic?

North America and Europe generate the most affiliate network traffic, accounting for about 75% of global traffic. However, regions like Asia-Pacific are rapidly growing.